Bar Market Continues to Expand, Evolve with Added Functional Benefits

Popular Form— Plus Function: Bar formats have multiplied from the single dough of the 1980s to today’s new offerings with more visual and textural interest

Low-cal, low-sugar protein bars use peanut and almond butters to deliver 10g to 11g of plant-based protein. Simply Delicious Inc., Boulder, Colo., says Bobo’s bars have just 10 ingredients with sweetening from organic honey rather than sugar alcohols.

PHOTO COURTESY OF: SIMPLY DELICIOUS INC. (WWW.EATBOBOS.COM)

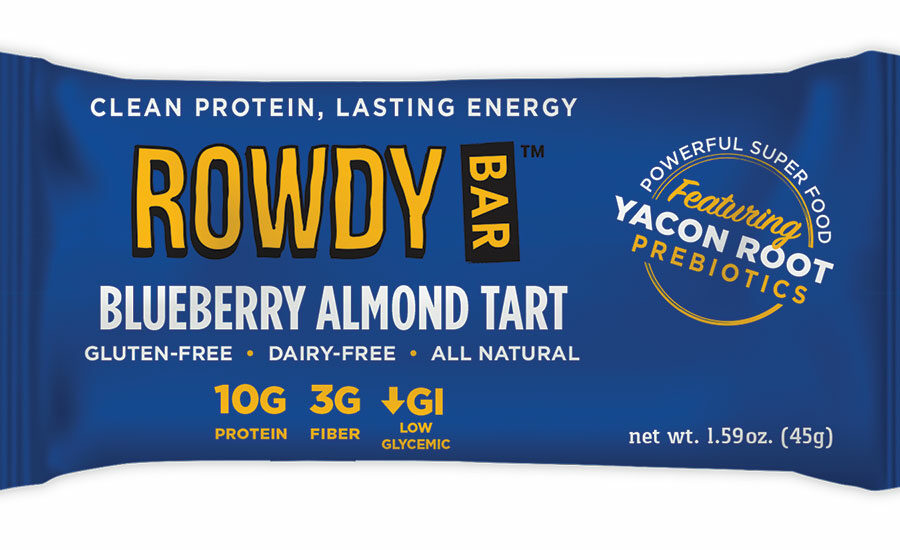

Rowdy Bars promote digestive health by emphasizing prebiotics, non-digestible carbohydrates that help feed the good bacteria in one’s gut. Rowdy Prebiotic Foods Co., Reno, Nev., identifies yacon root as a key ingredient.

PHOTO COURTESY OF: ROWDY PREBIOTIC FOODS CO. (WWW.ROWDYBARS.COM)

Vital Proteins, Franklin Park, Ill., used 2019 Natural Products Expo East to introduce six collagen bars, which deliver 15g of collagen, billed as “the most collagen. Vital Proteins says its collagen—from a grass-fed, pasture-raised bovine base—promotes “overall health and wellness.”

PHOTO COURTESY OF: VITAL PROTEINS LLC (WWW.VITALPROTEINS.COM)

All In Nutrition, Boston, says its new refrigerated bars have more protein, less sugar and fewer calories than leading competitors. All In Nutrition also says its bars earned the industry’s first Purity Award and “Clean Label” Certification from the Clean Label Project.

PHOTO COURTESY OF: ALL IN NUTRITION LLC (WWW.WICKEDPROTEIN.COM)

In 1962, NASA launched space capsule Aurora 7 into orbit with a brand-new type of sustenance for astronaut Scott Carpenter: space food sticks, a “non-frozen balanced energy snack in rod form containing nutritionally balanced amounts of carbohydrate, fat and protein.”

Developed jointly with a team of food scientists at Pillsbury, these extruded snacks later became a staple of the 1973 Skylab 3 mission, during which the crew was instructed to eat these bars every third day during the 60- to 85-day mission.

Later, these highly-specialized food sticks soon pivoted from astronauts to another consumer group looking for sustained performance: in 1986, long-distance runner Brian Maxwell founded PowerBar, designing his recipe with nutritionist Jennifer Biddulph to meet the high protein requirements of athletes.

With the evolution of snacking and consumer need for on-the-go nutrition rather than formal meal patterns, the nutrition bar space has expanded tremendously. Consumer demographics and psychographics have diversified, and so have their nutrition requirements, as well as the variety of formats and flavors available to satisfy a regular consumer.

Major ingredient trends in 2020 include protein in a range of concentrations and from an array of sources; sugar reduction, which often goes hand in hand with fiber supplementation; and more specific benefits like gut health and cognitive support. At the same time, bar formats have multiplied from the single dough of the 1980s to today’s new offerings with more visual and textural interest.

Protein Power!

Protein remains a major call-out nutrient across varying consumer groups and usage occasions. For strength-training athletes for example, high levels of protein provide the amino acid building blocks to rebuild muscle after a workout and support strenuous performance. For on-the-go dieters, protein also contributes to satiety between meals and moderate levels are complemented with a balance of carbs and fat.

Not only does the protein level in nutrition bars vary by consumer group and usage occasion, the source of protein itself is diversifying.

Whey is still the preferred protein of many athletes due to its complete amino acid profile and proven digestibility, with isolates typically viewed as more pure and premium versions compared to concentrates. Although it’s also a complete protein, soy protein has something of a negative halo in the sports world. However, it is significantly more affordable than dairy and may be acceptable to a more general consumer looking for a lower price per gram of protein. For other consumer groups, the negative perception of soy has instead led to a rise in popularity of other plant-based protein sources such as rice and pea.

Although veganism still represents a small segment of the American population, more consumers are experimenting with flexitarian diets. These consumers are more actively looking for product options that include both plant-based and animal-based ingredients.

From a formulation standpoint, different protein sources share certain technical challenges. These include dryness and chalkiness at high levels, drying out and hardening over shelf life, and non-enzymatic browning that might change the color of a bar.

In dairy applications, suppliers have fine-tuned their offerings towards functionality, with specific proteins designed to suck up less moisture from the syrup system and yield a moister texture for example; and others are segmented by particle size to avoid a gritty or sandy mouthfeel.

Specific proteins have been optimized to retain softness over shelf life, and lower-lactose options have been developed to limit browning reactions between reducing sugars and amino acids. However, with this degree of specialization, formulators must become intimately familiar with their options; and because one whey protein isolate may function very differently from another, manufacturers cannot swap between proteins as readily as the label declaration might imply. Those types of shifts can lead to supply chain disruptions and additional re-formulation work when a protein is temporarily unavailable and there is no viable alternative.

On the other hand, soy had been the main alternative to dairy protein until relatively recently, but consumers demand has risen for non-soy options such as rice and pea. Compared to soy, rice and pea tend to pose more textural difficulties, particularly dryness and grittiness. And because they are relatively newer to the market, options are more limited in terms of functionality and processing of the raw material is still progressing to reduce the more pronounced vegetal notes. Formulators must often screen multiple raw materials and carefully select the best combination for their application, but also explore congruent flavor profiles robust enough to cover any plant “off-notes” and leverage flavor suppliers’ new masking technologies.

New plant protein ingredients are constantly emerging from new and different sources, including pumpkin, watermelon and sunflower. But the incremental obstacles—compared to rice and pea—often are higher cost and lower protein concentration. These new sources may represent viable options for plant-based bars with moderate protein claims. For high-protein performance bars, the challenge is amplified, and blends may be preferred in order to balance protein level, cost, and sensory.

Carbohydrates: Sugar vs Polyols vs Fibers

In 2020, the FDA is rolling out new regulations on nutrition declaration for packaged foods, with two major updates the nutrition facts panel. Updates stipulate that added sugars must be listed along with a percent daily value, and that fiber may only come from specific sources.

Many consumers recognize that food inclusions such as fruits may come with some natural sugars. However, this new distinction of “added sugars” on the nutrition facts panel lead many to question why a bar might contain more than 10g of sugar added on top of that—whether in the form of traditional corn and tapioca syrups, or in the typically more friendly-looking form of honey and agave. In response, many brands look to reduce added and total sugars.

The challenge for formulators lies in the functionality of sugar syrups. Sugars make great binders between proteins and inclusions, while they also help retain product softness and pliability over time. Removing the binding syrup altogether, as some keto-friendly bar products have done, greatly reduces the bind and requires very tight manufacturing control to maintain product integrity.

Replacing a sugar syrup with a sugar alcohol like maltitol maintains bind and retains texture well over time, however certain consumers are increasingly wary of potential gastro-intestinal side effects from sugar alcohols. And replacing with a fiber syrup without further formula optimization can cause significant hardness and dryness over shelf life due to the moisture-retention properties of the fibers.

Allulose, a rare sugar not metabolized by the body and not counted in “total sugars” or “added sugars,” may complement other binders by reducing sugars. However, approval for allulose is still limited in various countries.

The other major impact of the new regulation is the definition and declaration of dietary fiber. Under the new regulation, carbohydrates may only be declared as fiber if they are intact; naturally occurring in a plant ingredient; or in the case of specified isolated synthetic carbohydrates, if the FDA has determined positive physiological effects that benefit human health.

As such, approved fibers may have demonstrated benefits for gut health, cardiovascular health, and others. However, this restricted definition poses some re-formulation difficulties. For example, isomalto-oligosaccharides (IMO), which had been widely used in the binding system of low-carb bars, were notoriously not approved as a source of fiber by the FDA. This decision led label fiber content to drop drastically, with a corresponding increase in sugars and other carbohydrates.

Brands that had been leveraging this ingredient in their nutrition bars to minimize net carbs on label faced a great challenge of reformulating to an approved fiber source or a sugar alcohol syrup, in order to bring their net carbs back down.

Functional Food

Although macro-nutrients dominate purchase decisions for nutrition bars, consumers also are looking for foods to perform certain functions beyond muscle recovery from protein. With on-the-go meals rising in popularity, another such function is energy support, which can be achieved with slowly-digested carbohydrates to sustain blood glucose levels and prevent extreme highs and lows. Electrolytes such as sodium and potassium—naturally occurring in many bars or added for flavor—also ensure proper cell function.

Consumers also are interested in digestive, or “gut” health, as we learn more about how gut health affects general well-being. For example, gut health could impact heart and kidney health via cholesterol metabolism. Micronutrient malabsorption in the digestive tract could also lead to conditions such as iron deficiency anemia, which could in part be alleviated by focusing on gut health. And gut health has even been linked to further-reaching effects on mental health, impacting sensory processing and mood management.

More health-minded consumers understand their gut microflora is composed of beneficial and detrimental bacteria, and they often think of probiotics when it comes to improving gut health. For example, many supplement their diets with raw kombucha or yogurt with live active cultures. The goal is to remodel their gut microbiome towards more beneficial bacteria and fewer of the detrimental ones.

For the formulator, it is important to keep in mind that not all probiotics are created equal. Strain selection is critical for scientific support, with different strains clinically tested in different populations and against specific health benefits. Additionally, there are manufacturing considerations such as sanitation requirements—associated with different strains.

However, even with careful strain selection, adding beneficial bacteria alone may not be enough to change the makeup of the gut flora. Without the appropriate prebiotics to feed these beneficial bacteria, they may not be able to colonize the gut and may pass through the digestive tract with no tangible benefit.

As mentioned previously, fiber syrups are one way to reduce sugars while retaining bind in nutrition bars. Interestingly, these syrups also can represent nutrition for the beneficial bacteria already established in consumer digestive tracts or supplemented through their diet. And reducing the proliferation of detrimental gut microbes is important as well, to which end consumers might alter their diets to reduce or eliminate sugar and refined carbohydrates for example. As such, customers look to the food product as a whole and certain negatively-perceived ingredients—such as high added sugar—might detract from the digestive health ingredients.

Another functional trend of interest involves cognitive support, against which formulators may include vitamin and mineral supplementation (whether a full vitamin-mineral premix or specifically targeted micro-nutrients). Consumers are well-aware of vitamin deficiencies associated with various disease states, such as scurvy due to lack of vitamin C, and rickets due to lack of vitamin D. In fact, a 2019 poll of Americans showed that 86% take vitamins, minerals or other supplements regularly—despite the fact that only 24% test deficient. This shows that supplementation is still a hot topic and a consumer need, despite the conflicting desire to shorten ingredient listings.

On the manufacturer side, certain vitamins pose sensory challenges. For example, B vitamins often touted for energy and cognition can have poor taste at high level and this may require encapsulation and/or flavor masking. Another consideration is shelf life and process sensitivity. For example, many of the B vitamins are stable to heat while vitamins A and C are not, so formulators must remain vigilant about where in the process they are adding micro-nutrients, as well as any overages needed to carry meaningful levels through manufacturing and storage.

Finally, with the broadening of the nutrition bar market, another more unique functionality for consumers involves their interest in skin health and beauty. A hot ingredient addressing this need is collagen, which may also support joint health. Additionally, certain vitamins and minerals can be added to target skin-related deficiencies, as well as some probiotics which have shown promise in clinical trials for specific skin disorders, such as eczema.

In conclusion, bars represent a vast opportunity for brands to grow into new formats. Although more brands are launching bars in a crowded space, product formats have concurrently expanded for differentiation. In contrast to the original extruded Space Sticks and the single-layer PowerBars, many nutrition bars now have multiple layers—crispy, crunchy, doughy, “caramelly,” “jammy “– as well as inclusions of all shapes and sizes to add textural interest. Even cleaner-label fruit and nut bars have become more visually complex, adding pops of color from fruit pieces and visible nut pieces.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!