Product Details

Prepared Food Equipment Market by Type (Pre-processing, Processing, Packaging), Application (Snack & Savory Products, Meat & seafood Products), Mode of Operation (Automatic, Semi-automatic, Manual), and Region - Global Forecast to 2026

Once purchased your report will be sent to you electronically via email. Please allow 1-2 business days for arrival

Pricing:

- Single User License: Allows the person purchasing the report and that person alone to view and use the report

- Corporate License: Allows the person purchasing the report and any colleague within the same organization to view and use the report regardless of location

Returns or Refunds - The electronic format and type of information provided by Canadean and ICD Research is such that Canadean and ICD Research cannot accept returns of products once they have been dispatched. Refunds will only be considered where the product does not accurately reflect what is being advertised. Refunds may occasionally be offered at the discretion of the management

[225 Pages Report] The global prepared food equipment market size is estimated to account for a value of USD 10.4 billion in 2020 and is projected to grow at a CAGR of 6.4% from 2020, to reach a value of USD 15.1 billion by 2026. The rise in disposable income of the population, changes in consumption patterns, and manufacturers' investment in developing innovative products on production efficiency, processing time, and quality of food products are expected to fuel the demand for prepared food equipment.

COVID-19 impact on Prepared Food Equipment market

With the lockdown imposed by governments due to the COVID-19 pandemic, restaurants, food outlets, and catering businesses were shut down, which has affected the equipment manufacturers' sales. Although the food consumption was more as people were at home, the food equipment market got affected worldwide due to the COVID-19 pandemic. It has impacted the meat products market due to the negative publicity by social media on the health risks associated with animal-based products' consumption. Simultaneously, the bakery and convenience food products market witnessed good growth as they are readily available and tasty to eat.

Prepared Food Equipment Market Dynamics

Driver: Rise in income to drive the demand for prepared & convenience foods

The rise in disposable income due to growth in the economy, especially in emerging countries such as India and China, has led to an increase in demand for prepared & convenience foods. With the rising demand for convenience and ready-to-eat (RTE) food, customers are also concerned about the nutritional and health benefits of such food items before consumption. This is achieved by automating or integrating the overall processes, which help maintain food quality and nutritional value.

Restraints: Increase in demand for minimally processed, healthier organic food products

The rise in the aging population in developed countries has led to an increase in health concerns. There is a high preference for fresh and minimally processed food products without synthetic chemical preservatives. This adversely affects the demand for prepared food equipment as prepared foods are processed with preservatives and other flavoring agents to increase the shelf life and enhance palatability.

Opportunities: Demand for advanced machinery with high productivity and efficiency

Food manufacturers continue to look for advanced machinery and delivery solutions to meet safety standards and increase productivity to meet consumer demand changes. Key players such as GEA Group (Germany), Alfa Laval (Sweden), and Marel (Iceland) in food manufacturing are mostly focused on increasing the level of automation in food processing operations to increase the predictability of preventative maintenance, lead time of processing, and connectivity.

Challenges: Infrastructural challenges in developing countries

The saturated markets of developed economies such as the US, the UK, Germany, and France compel manufacturers of prepared food equipment to search for untapped markets and expand their consumer base. This requires substantial investments in many aspects of business expansion, especially with regard to the establishment of new facilities in developing countries. Setting up large equipment requires larger lands and high manpower, which makes it difficult for manufacturers to set up plants in developing countries due to the lower availability of labor and land.

Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By type, the packaging is projected to be the fastest-growing segment in the prepared food equipment market during the forecast period.

The packaging segment is further segmented in primary and secondary packaging.. Packaging of prepared food products is carried out to avoid contamination of the products, reduce wastage during transport & handling, and extend their shelf life. Automated equipment is used in developed countries to standardize the packaging, enhancing the food product's value.

By application, the snacks & savory products segment is projected to dominate the Prepared Food Equipment market during the forecast period.

Every household consumes snacks & savory products as it is easily available and tasty for consumption. With the growing concerns for healthy food options, varieties of snacks are made available, gluten-free, lactose-free, and rich in nutrients.

The automatic segment is projected to be the highest growing segment in the Prepared Food Equipment market during the forecast period by mode of operation.

The ease of use and higher production of food products in lesser time drive the market for automated prepared food equipment. Like the US and Germany, most countries opt for automated equipment to cater to the increasing demand for processed foods domestically and internationally.

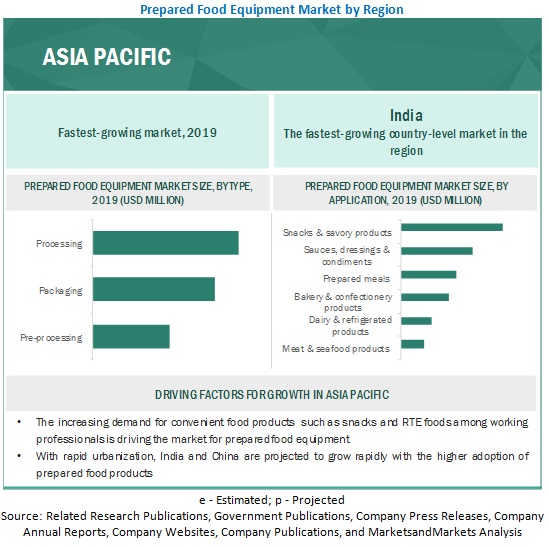

The increasing demand for convenience foods Asia Pacific region is driving the Prepared Food Equipment market's growth.

The demand for prepared food equipment is expected to increase in the Asia Pacific region due to the growing retail industry and increased working professionals. The shift to automated equipment and the application of automation in ready-to-eat food and on-the-go food products, with an increasing population, drives the demand for prepared food equipment. The growing innovations in prepared food equipment are also expected to drive the Asia Pacific region's market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, and Mode of operation |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

GEA Group (Germany), Alfa Laval (Sweden), JBT Corporation (US), SPX FLOW (US), Bühler (Switzerland), Tetra Laval (Switzerland), Dover Corporation (US), Robert Bosch (Germany), Krones (Germany), Middleby Corporation (US), Marel (Iceland), IMA Group (Italy), Multivac (Germany), Ali Group (Italy), Lyco Manufacturing, Inc (US), Heat and Control, Inc. (US), BigTem Makine (Turkey), Hup Sheng Machinery & Industry (Malaysia), Sumpot (China), and Hosokawa Alpine (Bayern). |

This research report categorizes the Prepared food equipment market based on type, application, risk category, supply chain, and region.

Based on type:

- Pre-Processing

- Cleaning, sorting and grading equipment

- peeling and cutting equipment

- Others (conveying, picking, and placing)

- Processing

Mechanical processing equipment

- heat processing equipment

- Others (stretching equipment, molding and pressing, and refrigerating equipment)

- Packaging

- Primary packaging equipment

- secondary packaging equipment

- Others (ancillaries, auxiliaries, and material handling systems)

- Packaging

Based on application:

- Snacks & savory products

- Prepared meals

- Sauces, dressings & condiments

- Bakery & confectionery products

- Dairy & refrigerated products

- Meat & seafood products

Based on the mode of operation:

- Automatic

- Semi-automatic

- Manual

Based on the region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (South Africa, Middle East and Rest in Africa

Key Market Players

Key players in this market include GEA Group (Germany), Alfa Laval (Sweden), JBT Corporation (US), SPX FLOW (US), Bühler (Switzerland), Tetra Laval (Switzerland), Dover Corporation (US), Robert Bosch (Germany), Krones (Germany), Middleby Corporation (US), Marel (Iceland), IMA Group (Italy), Multivac (Germany), Ali Group (Italy). These major players in this market focus on increasing their presence through expansions, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.

Recent Developments:

- In November 2020, GEA is divesting two companies; barn equipment & milk cooling, which were part of the Group’s Farm Technologies division. It will now be part of Mutares SE & Co. KGaA (Germany), which will continue to offer a wide range of manure handling products and systems, mainly in the North American market.

- In October 2020, Alfa Laval opened a new global application & innovation center for fluid handling technology in Denmark to strengthen its global position within food & pharmaceuticals, which are the company's core businesses.

- In May 2019, Bühler launched Tubex Pro for an advanced weighing solution. This would help the company to serve more enhanced equipment to its clients as these weighing machines are helpful to check even minute deflections in weights.

- In April 2019, JBT Corporation signed an agreement to acquire Proseal (UK), a tray sealing technology provider to the food processing industry. This acquisition would strengthen JBT’s position in the food packaging market.

- In April 2019, Tetra Pak launched a connected packaging platform; this would transform juice and milk cartons into interactive information channels, digital tools, and full-scale data carriers.

Frequently Asked Questions (FAQ):

Which are the key market players in the prepared food equipment market?

What are the challenges that can be faced by market players?

Name some of the prepared food equipment types followed by the companies.

Which are the drivers that support the growth of the prepared food equipment market?

How has the COVID-19 pandemic affected the prepared food equipment market?