2022 PREDICTIONS | E-COMMERCE

eCommerce Accounts for a Significant Share of Grocery Sales

Online Doing Just Fine: A recent survey found that 52% of shoppers purchased groceries online in 2020 which grew to 64% in 2021

PHOTO COURTESY OF: Getty Images / Kwangmoozaa

If we thought 2021 was going to be a return to “normal,” we were in for a big surprise. This past year was anything but normal. What some thought was temporary adaptation to an unexpected retail store challenge, has proven to be a transformational period for our industry with eCommerce in the forefront.

According to an FMI survey, 52% of shoppers purchased groceries online in 2020 which grew to 64% in 2021. This shift toward eComm has stickiness, with growth from all generational groups. So, what can we expect in 2022?

Enhanced Capabilities of Third-Party Marketplaces

Amazon has long owned the third-party (3P) marketplace segment in the US with a 57% share compared to Walmart at 11% and Target at 7% (according to Statista). This is due in large part to the convenient fulfilment solution Amazon offers sellers with its Fulfillment by Amazon (FBA) Program.

Walmart now offers its own brand of fulfillment services that may be a game changer for its 3P marketplace. Marketplaces will continue to grow and gain relevance with consumers and will offer increasing ease for sellers through programs like Amazon’s multi-channel fulfillment and expanding marketing opportunities.

Sustainable Solutions: In 2020 eCommerce retailer Thrive Market featured 47 new regeneratively grown items and said it shipped every delivery box with a carbon-neutral footprint and recyclable materials. PHOTO COURTESY OF: Thrive Market

Online Discovery

Conventional wisdom was that consumers buy from the first page of search results when shopping online. We have seen that change in the last two years and believe it will continue as consumers use eCommerce, rather than stores, as their source of product discovery.

Brands continue to experience hurdles with new-item placement in brick-and-mortar—so both brands and consumers are turning to eCommerce for product discovery opportunities. Only 22% of searches on Amazon include a brand name, according to Marketplace Pulse. Consumers search features and benefits of products, thereby surfacing a broad selection of brands for consideration. While great for consumer trial, and opening opportunity for small, digitally savvy brands, this trend is testing loyalty to major CPG brands.

Sustainable and Healthy

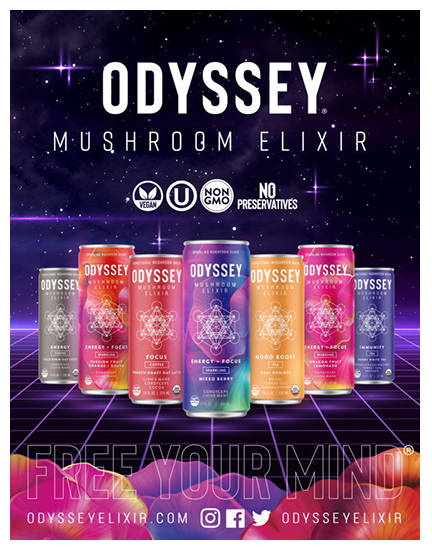

Discovery Channel: Consumers like discovering interesting new products online. Odssey Wellness says its new functional drinks are available at Amazon.com, the company website, and at select retailers. PHOTO COURTESY OF: Odssey Wellness LLC

The term “sustainability” has gotten chatter but questionable action over the years and is now of greater focus in eCommerce. Sustainability in eCommerce may sound like an oxymoron, but consumers are looking for true action in this arena, reflected in a variety of ways from efficient and recyclable packaging from brands, to slower shipping options that lower environmental impacts.

Amazon has launched a “Climate Pledge” certification program and other online retailers like Thrive Market are building their reputation on sustainability. Shoppers also are seeking healthy, more natural food options online. These two trends are particularly meaningful to millennial and Gen Z consumers who are actively seeking brands that align with their values, and this bodes well for some well-positioned small online retailers.

Evolving Shopping Behaviors

Brands that have taken the initiative to launch their own Direct-to-Consumer sites are seeing their efforts pay off. The uptick in this trend during the early days of the pandemic has continued, resulting in the growth of consumer subscription, engagement with consumers through unique offerings and value-adds such as recipes.

Consumers continue to gravitate to mobile and voice technology as their primary path to online shopping. Delivery times for grocery home delivery services, like Instacart, continue to decrease. Grocery retailers are focusing on honing their fabulously successful click-and-collect models, because they understand, there is no “going back” to the way of shopping we knew two years ago.

Many of these trends were accelerated by, or are the result of, the pandemic but it is clear that eCommerce will continue to account for a greater share of our grocery dollars.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!