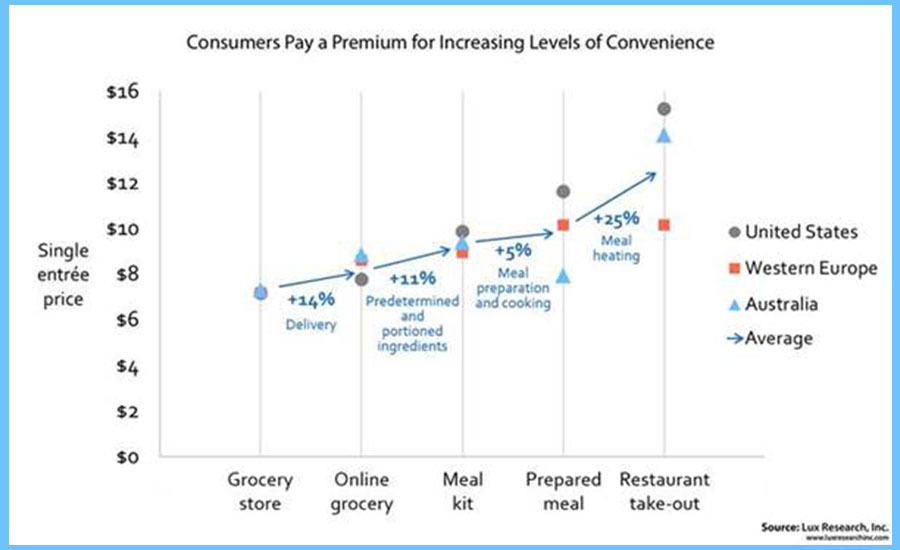

New business models are giving consumers more options for how they can obtain and prepare their food. The success of these approaches has demonstrated that consumers will pay an average of 11% more for each added layer of convenience in the food chain, from online grocery delivery to ready-to-eat restaurant take-out, according to Lux Research.

On a global level, online grocery commanded a 15% premium over in-store purchases, while meal kits were priced 11% higher than online grocery, prepared meals cost 5% more than meal kits, and restaurant take-outs were priced 25% higher than prepared meals.

The findings came from a study of the US, Western Europe, and Australia, three regions that are home to the most number of food startups. However, price premiums varied across regions, highlighting the importance of understanding consumer needs across specific demographics.

“Convenience is king, with increasing convenience garnering higher price premiums. Consumers pay increasingly higher price premiums for the convenience of having to do less,” said Camilla Stice, Lux Research Analyst and lead author of the report titled, “Assessing New Food Business Models: Putting a Price on Convenience.”

“Consequently, developers of new food business models should focus on ensuring they deliver multiple convenience factors to attract consumers,” she added.Lux Research analysts evaluated price differences and emerging business models in the food industry in three key markets – the US, Western Europe, and Australia. Among their findings:

Premiums vary by region. In the US, consumers pay the highest premium of 21% for meal kits, which offer consumers predetermined and premeasured ingredients, a premium 10% higher than the global average. In Western Europe, consumers actually pay 1% less for restaurant take out as compared with prepared meal delivery, demonstrating the value of a flexible eating schedule. Australians pay 44% more for the convenience of ready-to-eat meals versus prepared meals that require heating.

New business models focus on delivery. Nearly all new food business models include delivery, signaling a shift in industry standards and consumer preferences. Delivery of meals no longer stands out as a differentiating point and business models focusing on convenience will risk failure without delivery.

The future lies in personalization and on-the-go services. Aligning with increasingly mobile lifestyles, food delivery services will expand outside the home, offering the next level of convenience. Alongside, developers will diversify to include personalization based on health status, flavor preferences, and even current mood.

Added Convenience in Food Business Models

Start-up companies from Blue Apron to UberEATS are developing new business models and demonstrating consumers’ willingness to pay for convenience

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!